Health insurance is a self-protection that should be owned by the individual. Buying health insurance is a wise choice because it not only protects you from various health risks but also protects your finances in the future. Know in advance the considerations before buying health insurance in California.

If you’re always up to date with health news, California is one of the cities in the United States with the highest healthcare costs. California is ranked sixteenth out of some cities in the United States. So you don’t get caught up in expensive medical expenses when you suddenly have to get treatment at the hospital, it’s best to save for a rainy day.

Follow this discussion to get complete information about health insurance and key points that you should consider when choosing insurance.

Key Points to Consider when Purchasing California Health Insurance

If you have never purchased insurance at all, be more careful in choosing the plans offered. Please take a look at some of the following considerations:

1. Coverage Level

Generally, some insurance companies in California will offer four levels of coverage consisting of platinum, gold, silver, and bronze. The four levels provide the same coverage benefits, but insurance companies differentiate medical costs for each level.

For example, if you choose a platinum plan, the insurance company will require you to pay a high monthly premium. Thus, you will use a lower cost per service when getting treatment at the hospital so you don’t have to incur additional costs from your pocket.

Meanwhile, if you choose the bronze plan or the lowest level, the monthly premium you have to pay is more affordable. However, insurance companies will provide low deductible rewards. As a consequence, the payment per treatment fee is higher compared to the platinum plan.

Considering that all the health coverage benefits provided are the same for all levels, make sure you choose a level that suits your paying ability. As a result, you can get proper health services and have no trouble paying premiums.

2. Types of Plans

Health Insurance California has three types of plans, namely HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), and EPO (Exclusive Provider Organization).

If you choose the HMO plan, the healthcare providers you can visit for treatment are under the HMO contract. However, in an emergency, this can be skipped so you can get a referral to a specialist. The referral was obtained from a PCP (Primary Care Physician).

You can choose the PPO plan if you want it to be more practical because you don’t need a referral from the PCP to seek treatment from a specialist. However, the health provider services that you can visit are only within your network.

The EPO plan can be the best choice for those of you who have no financial issues because this plan offers high flexibility to its consumers. You can use the health services that are in the network or outside the network.

If you choose an out-of-network health service provider, you will have to pay an additional fee. The consequence of high flexibility is expensive monthly premiums.

3. Network Providers

Knowing that each plan has a specific network, make sure to choose a plan that provides a network that suits your needs. To get valid information about the network, you should ask the network provider.

Don’t hesitate to ask if the doctor you choose is included in the network plan that you are going to buy. Usually, the larger the provider’s network, the more choices of doctors around you. You should not skip this key point because it will be directly related to the health services that you will get later.

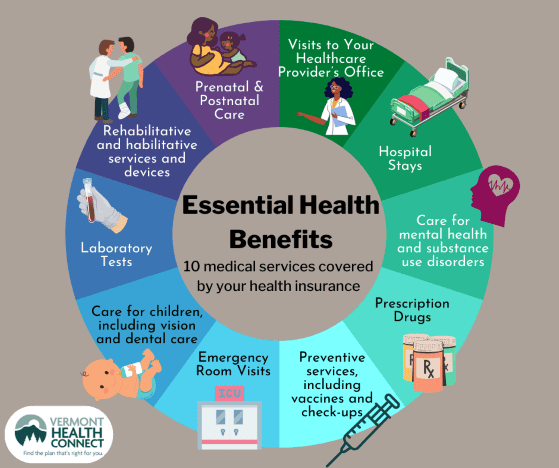

4. Essential Health Benefits

Premiums are always an important consideration before buying health insurance California. However, you also need to consider the essential health benefits you will get.

To get the maximum benefit, please choose an insurance plan that provides coverage for health problems that you often or are prone to facing. For example, if you are undergoing treatment that requires you to take certain medicines, cross-check whether the insurance will cover these medicines.

If there are health care costs or certain types of doctor’s prescriptions that are not covered by insurance, ask in detail what range of additional costs you have to spend.

5. Total Cost

To get a clear picture of the costs you will incur if you buy health insurance, you can request a total cost simulation. Insurance companies generally have tools for totaling simulated costs so you can compare them to others.

The tool will need detailed information about you to make calculations that suit your needs and capabilities. The total cost simulation results will help you choose the right premium or find alternative plans that are more affordable.

Bagikan