From various kinds of insurance offers, you may never think that life insurance is as important as health, vehicle, and home insurance. Unlike property that you can replace, your life is far more important than that, for you and also your family’s future. There are many reasons why life insurance quotes are important.

So if you’re curious about the policy, find out the benefits and reasons here!

What Does it Mean by Life Insurance Quotes?

Technically, life insurance is an agreement or contract between you and the life insurance company. You will pay some money to buy an insurance policy, as a guarantee in old age.

This life insurance will cover all costs of death and also provide coverage, for other costs that cause death, accident, illness, and others. The various benefits that you get also depend on the insurance policy that you buy. As with other insurance, you can also choose a package according to your needs.

Life insurance companies will usually offer insurance ranging from packages with the lowest premium payments to the highest. Costs covered under the policy usually include funeral costs.

Therefore, life insurance quotes are important. You must immediately register your life insurance so that the quota is still there. This relates to funeral processions, which have limited space.

The Benefit of Having Life Insurance

The main reason for life insurance is to help you have financial stability for the people you leave behind. So when you leave this world, your family will no longer have to worry about how they will have to pay for the funeral expenses.

On the other hand, having life insurance quotes can be useful so you can make sure you get death insurance later. Moreover, if you have a hereditary disease or other diseases in old age.

The customer can claim compensation for hospital fees, for several events that happened to him and made him leave. For example, if you get sick or have an accident and eventually die, life insurance can cover these costs, up to funeral costs.

But, this goes back to the agreement and insurance policy that you pay for. At least, you can give peace and financial stability to the family members you left behind.

Why Should People Have Life Insurance?

Life insurance is useful for those of you who have family members who depend on your financial income. So when you die later, your departure will have a significant impact on them. Because one of the financial backbones of the family has gone.

On the other hand, they also have to move on with their lives. That’s why you need to immediately register life insurance quotes.

In return, life insurance claims are not only about your future but also your family with the following benefits:

- Life insurance pays for final expenses, funerals, and burial.

- Gives compensation for your income, so that your family gets your income. They will also pay for the policy fee and daily expenses.

- Pays your debt left behind family.

- Provides financial guarantees for children’s schools.

- Helps provide financial stability for child care.

Thinking about the future for you and your family, you might need this life insurance as a form of concern for peace in the future. You can allocate your money even when you are away.

In addition, you can also choose to donate your money later as charity, to people who you think are important to you. All of these choices are yours.

Kinds of Life Insurance Quotes

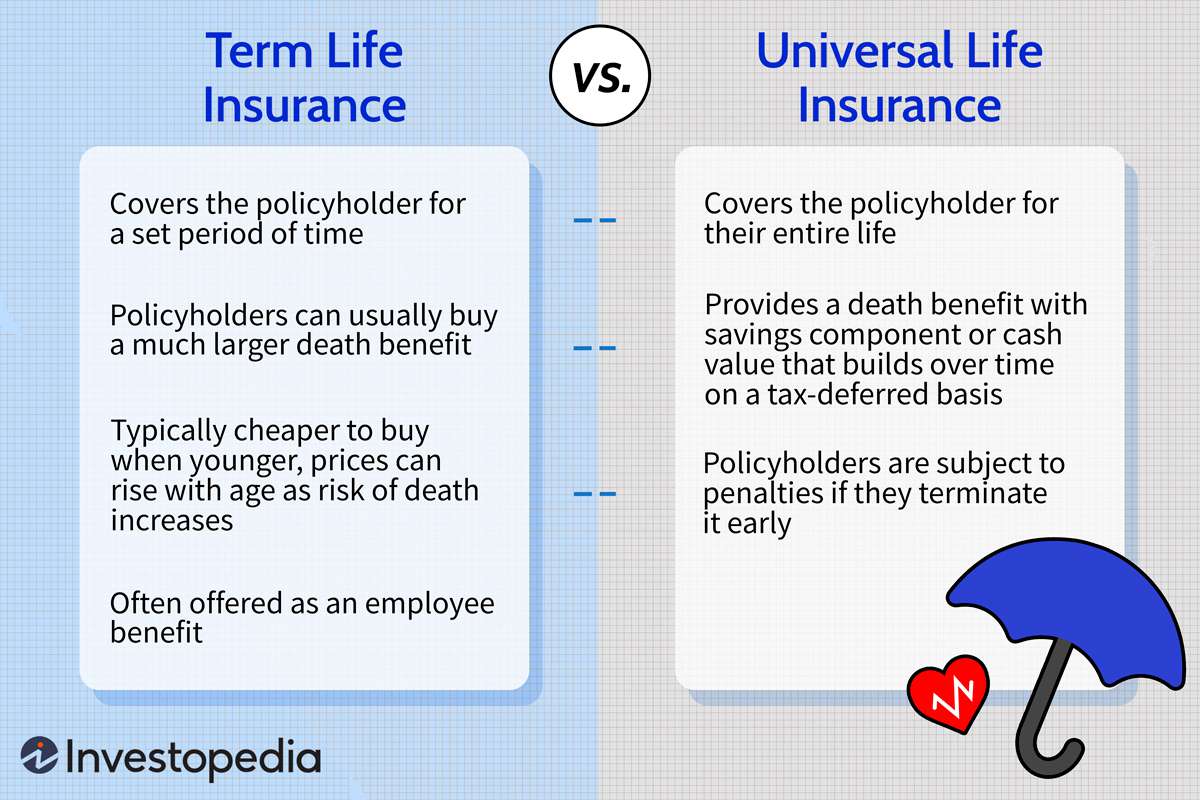

Before you register your life insurance, you need to pay attention that two types of life insurance are often offered by insurance companies. You just need to choose which one is best for you and your family’s future.

1. Term of Life

Term of life is a life insurance guarantee that you can adjust based on the period. Is it 5, 10, 20, or 30 years, depending on your choice? This term of a life insurance claim can be paid only when you die during that period. So if you die when the period is over, you cannot receive several benefits.

The longer the period you choose, the higher your chances of getting life insurance quotes. In this term of life insurance, you also pay less than the permanent type. For example, Pacific Life is a life insurance company that offers a guaranteed term of life insurance quotes.

There are many types of insurance policies that you can choose from, such as term life, whole life, child life insurance rider, estate protection rider, and many more. Its varied offerings and long experience have made this company trusted and included in the list of companies with an A+ rating.

2. Permanent Life Insurance

Permanent life insurance offers life insurance for life. With this permanent life insurance, you can claim life insurance whenever you die. This insurance is also able to cover more costs than the terms of life.

However, this permanent type is also much more complicated, so you need to pay attention to all the details on your insurance policy before choosing. On the other hand, you also have a greater chance of getting life insurance quotes.

Most large life insurance companies have two types of terms life insurance, and permanent. For example, Penn Mutual is an A+-rated international company that also offers a term of life and whole life insurance quotes.

This company offers insurance coverage such as accidental death benefit riders, child life insurance riders, disability riders, terminal illness accelerated death benefits, and others.

Your Life Matters to Anyone

On the day your life truly ends, you may leave in peace, but what about the people you left behind? This is the main reason why life insurance quotes are the best way to give peace because your life is meaningful and important for the loved ones you left behind.

So if you want to make sure everything goes well, even after you leave, then life insurance will help you. Remember to check the details before subscribing to a policy. Therefore, which of the available life insurance will you purchase?

Bagikan